- Why Hydrogen Is Suddenly Everywhere

- What Makes Hydrogen Unique as an Energy Carrier

- Why Hydrogen Is Called the Missing Link in Decarbonization

- The Many Shades of Hydrogen: Grey, Blue, Green (and Beyond)

- Why Green Hydrogen Gets All the Spotlight

- The Technology Powering Hydrogen Energy

- Where Hydrogen Is Already in Action Today

- Why Hydrogen Adoption Remains So Slow

- Who’s Investing Billions in Hydrogen

- The Road Ahead: Can Hydrogen Compete by 2030?

- FAQ + Conclusion + Call-to-Action

Why Hydrogen Is Suddenly Everywhere

If you’ve been following energy news lately, you’ve probably noticed one thing: hydrogen is suddenly everywhere. From flashy government press releases to billion-dollar corporate bets, hydrogen has gone from a niche science project to the centerpiece of global climate strategies.

But here’s the question: is this hype, or is hydrogen finally ready to deliver?

Why the World Is Paying Attention Now

There are three big reasons hydrogen is dominating headlines in 2025:

- Climate Deadlines Are Looming: Countries can’t hit net-zero targets without decarbonizing industries that electricity alone can’t fix.

- Geopolitics & Energy Security: The world wants to reduce dependence on oil and gas imports, and hydrogen offers a flexible option.

- Money Is Flowing: The U.S., EU, and Middle East are pumping hundreds of billions into hydrogen hubs, pipelines, and pilot projects.

Hydrogen has moved from the lab to the boardroom, and that’s why every policymaker, investor, and engineer is paying attention.

Positioning Hydrogen in the Clean Energy Narrative

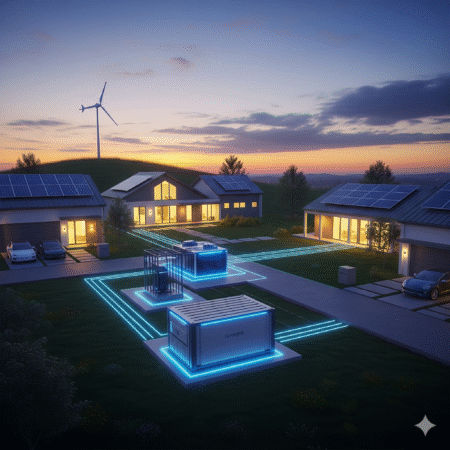

So where does hydrogen fit in the clean energy story? Let’s be clear: it’s not here to replace solar panels, wind turbines, or batteries. Instead, hydrogen plays the role of the missing puzzle piece-filling in the gaps where electrification doesn’t make sense.

Think of it this way:

| Energy Option | Strengths | Weaknesses |

|---|---|---|

| Electricity + Batteries | Great for cars, homes, and short-term storage | Limited range, heavy for long-haul transport, struggles in heavy industry |

| Hydrogen | Versatile fuel, can store energy long-term, zero emissions at point of use | Expensive today, needs infrastructure |

| Fossil Fuels | Reliable, global infrastructure | High emissions, not sustainable |

Hydrogen isn’t the silver bullet-but without it, the net-zero equation doesn’t balance.

The WHY Behind the Hype

- It’s light, abundant, and versatile-the most common element in the universe.

- At the point of use, hydrogen is zero-emissions (the only byproduct is water).

- It can decarbonize sectors that electricity can’t reach, like steelmaking, cement, and aviation.

This is why hydrogen is suddenly everywhere: not because it’s perfect, but because it’s the only real shot at tackling the toughest parts of the climate challenge.

Bottom line: Hydrogen isn’t just another energy buzzword-it’s the bridge fuel that could finally connect today’s fossil-heavy world with tomorrow’s clean-energy future.

What Makes Hydrogen Unique as an Energy Carrier

Here’s the truth: hydrogen isn’t just another fuel. It plays by a different set of rules compared to oil, coal, or even electricity stored in batteries. That’s why it’s capturing so much attention right now.

Light, Versatile, and Abundant

Hydrogen is the most abundant element in the universe. It’s light, it can be stored in different forms (gas, liquid, or bound to other carriers), and it can be used across multiple industries-transport, power, chemicals, and even heating.

Unlike fossil fuels that are locked underground or batteries that depend on scarce metals, hydrogen can be produced locally almost anywhere if you have water and energy.

Zero Emissions at Point of Use

When hydrogen is burned or used in a fuel cell, the only byproduct is pure water (H₂O). That’s a game-changer because it allows industries to cut emissions without changing the way they operate.

Imagine steel factories running with hydrogen furnaces or trucks powered by hydrogen fuel cells-suddenly, dirty industries can go clean without waiting for a miracle technology.

The Batteries vs Hydrogen Debate

People often ask: “Why not just use batteries for everything?” Great question. Batteries are fantastic for short-range cars, homes, and small devices. But when it comes to heavy transport, long-term storage, or high-temperature industries, batteries hit their limit. That’s where hydrogen shines.

Here’s a quick comparison:

| Feature | Batteries | Hydrogen |

|---|---|---|

| Best Use Case | Cars, homes, small devices | Heavy trucks, ships, steel, grid storage |

| Energy Density | Lower (heavy & bulky for long-haul) | Higher (lightweight per unit of energy) |

| Byproducts | None (but depends on battery recycling) | Only water at point of use |

Why This Matters

Hydrogen is not competing with batteries-it’s complementing them. Electricity will power most of our daily lives, while hydrogen will step in where batteries and grids can’t keep up. That combination is why experts call hydrogen the “energy carrier of the future.”

Bottom line: Hydrogen’s uniqueness lies in its flexibility. It’s the only fuel that can move seamlessly between sectors, scale across industries, and still deliver clean energy without carbon baggage.

Why Hydrogen Is Called the Missing Link in Decarbonization

Here’s the big WHY: despite all the progress in renewable energy and electrification, some industries are still stuck in the carbon trap. Solar, wind, and batteries alone can’t carry the entire burden of decarbonization. That’s where hydrogen enters as the missing link.

Hard-to-Abate Sectors

Certain industries are nearly impossible to decarbonize using electricity alone:

- Steel and Cement → need extremely high heat (over 1,000°C)

- Heavy Transport → trucks, ships, planes where batteries are too heavy

- Chemicals & Fertilizers → require hydrogen as a raw material, not just energy

Without hydrogen, these industries can’t hit net-zero targets.

Where Electrification Alone Falls Short

Electrification is powerful for homes, cars, and light industry-but the physics don’t work everywhere.

- Batteries lose efficiency over long ranges.

- High-energy processes like steelmaking can’t run on electricity cost-effectively.

- Seasonal energy storage (keeping excess solar/wind for months) is nearly impossible with batteries.

Hydrogen solves this by acting as a long-duration, high-density energy carrier.

Hydrogen as the Bridging Solution

Hydrogen fills the gaps that renewables and batteries can’t. Think of it as the Swiss Army knife of clean energy:

- Burn it for heat

- Use it in fuel cells for electricity

- Apply it as feedstock for industry

It enables countries to bridge the gap between today’s fossil-heavy system and tomorrow’s net-zero world.

Quick Snapshot: Why Hydrogen Matters

| Challenge | Why Electricity Fails | How Hydrogen Helps |

|---|---|---|

| Steel & Cement | Requires ultra-high heat beyond what electricity provides economically | Hydrogen furnaces deliver high temperatures with zero emissions |

| Heavy Transport | Batteries too heavy & slow to recharge | Hydrogen fuel cells offer lightweight, fast refueling |

| Seasonal Storage | Batteries too costly for months-long storage | Hydrogen can be stored in tanks, pipelines, or underground |

Bottom line: Hydrogen isn’t competing with electricity-it’s completing it. Without hydrogen, the path to net-zero looks more like wishful thinking than reality. With hydrogen, the missing puzzle piece finally fits.

The Many Shades of Hydrogen: Grey, Blue, Green (and Beyond)

Here’s the thing: not all hydrogen is created equal. When you hear people say “hydrogen,” they’re not always talking about the same thing. The color labels-grey, blue, green, pink, turquoise, and even yellow-aren’t literal, but they matter because they show how that hydrogen is produced and how clean it really is.

Let’s break it down.

Grey Hydrogen: The Dirty Majority

- Produced from natural gas using steam methane reforming (SMR).

- Cheapest option today, but also the dirtiest: emits ~10 kg of CO₂ per 1 kg of hydrogen.

- Makes up 95% of hydrogen currently in use worldwide.

Blue Hydrogen: Grey’s Cleaner Cousin

- Still made from natural gas (SMR), but adds carbon capture and storage (CCS).

- Cuts emissions by 50–90% depending on capture efficiency.

- Seen as a “transition fuel” until green hydrogen becomes cheaper.

Green Hydrogen: The Holy Grail

- Produced via electrolysis of water, powered by solar, wind, or hydropower.

- Zero emissions if the electricity source is renewable.

- Most expensive today, but costs are falling as electrolyzer technology scales.

Pink, Turquoise, and Yellow Hydrogen (The Niche Players)

- Pink: made with nuclear-powered electrolysis.

- Turquoise: uses methane pyrolysis, producing solid carbon instead of CO₂.

- Yellow: electrolysis powered by grid electricity (emissions depend on grid mix).

They’re still niche, but worth watching as innovation continues.

Quick Comparison Table

| Hydrogen Type | Production Method | Emission Impact |

|---|---|---|

| Grey | Natural gas (SMR, no CCS) | High emissions (~10 kg CO₂ per 1 kg H₂) |

| Blue | Natural gas + CCS | Medium emissions (50–90% lower than grey) |

| Green | Electrolysis w/ renewables | Near zero emissions |

The bottom line: when governments, investors, or the media say “hydrogen is clean,” they usually mean green hydrogen. Grey hydrogen is cheap but dirty, blue is the compromise, and green is the future everyone’s betting on.

Why Green Hydrogen Gets All the Spotlight

When people talk about the “future of hydrogen,” they’re almost always talking about green hydrogen. Why? Because it’s the only type that truly lives up to the promise of clean energy. Let’s break down the hype-and the reality.

Read More: Hydrogen Is the New Oil? How Industrial Giants Are Racing to Go Green

100% Renewable, 100% Clean

Green hydrogen is made by splitting water (H₂O) through electrolysis, powered by solar, wind, or hydropower. That means:

- Zero CO₂ emissions if renewables are used.

- No reliance on fossil fuels like natural gas or coal.

- It’s the closest thing we have to a “pure” clean fuel.

Think of it as the holy grail-the fuel that could power industries without leaving a carbon footprint.

The Climate Neutrality Advantage

Governments and corporations chasing net-zero goals see green hydrogen as their ticket to compliance.

- The EU wants 10 million tons of renewable hydrogen produced annually by 2030.

- Japan, Germany, and Australia are already investing billions to scale production.

- Major companies like Siemens, Shell, and Toyota are building full supply chains around it.

In other words: if the world is serious about meeting 2050 climate targets, green hydrogen isn’t optional-it’s essential.

Where the Big Money Is Flowing

Here’s what the investment landscape looks like right now:

- U.S. Inflation Reduction Act (IRA): offers up to $3 per kg subsidy for clean hydrogen.

- EU Hydrogen Bank: earmarked €3 billion to kickstart projects.

- Middle East (Saudi & UAE): betting on mega projects like NEOM, which will export green hydrogen globally.

Follow the money, and it’s clear: investors are putting their chips on green hydrogen.

Quick Snapshot: Why Green Wins

| Factor | Blue Hydrogen | Green Hydrogen |

|---|---|---|

| Emissions | Reduced (depends on CCS efficiency) | Near-zero (if 100% renewables) |

| Public Perception | “Transitional” fuel | “True clean” fuel |

| Investment Trend | Moderate | Exploding |

Bottom line: Grey is cheap but dirty, blue is a compromise, but green hydrogen is the endgame. It’s the one everyone-from policymakers to Wall Street-is betting will define the clean energy future.

The Technology Powering Hydrogen Energy

If hydrogen is going to live up to its hype, it needs tech muscle behind it. The good news? We already have the core technologies in place. The bad news? Scaling them is still a monster challenge. Let’s break it down.

Electrolysis: Splitting Water into Power

- How it works: Uses electricity (ideally from renewables) to split water (H₂O) into hydrogen and oxygen.

- Why it matters: This is how we get green hydrogen, the cleanest version.

- Challenge: Electrolyzers are expensive, and electricity demand is huge.

Steam Methane Reforming (SMR) + Carbon Capture (CCS)

- How it works: Natural gas reacts with steam to produce hydrogen and CO₂. Add CCS, and you trap the carbon.

- Why it matters: Today, 80% of global hydrogen comes from SMR. Adding CCS makes it “blue hydrogen.”

- Challenge: CCS isn’t perfect; leaks and capture efficiency are still hot debates.

Fuel Cells: Turning Hydrogen Back into Electricity

- How it works: Hydrogen reacts with oxygen in a fuel cell, producing electricity, heat, and only water as exhaust.

- Why it matters: Fuel cells power cars, buses, and even trains-making hydrogen a clean transport fuel.

- Challenge: Fuel cell costs are dropping, but durability and mass adoption are still uphill battles.

Quick Comparison of Hydrogen Tech

| Technology | Strength | Challenge |

|---|---|---|

| Electrolysis | Zero-emission hydrogen (if renewable-powered) | High electricity cost, low efficiency |

| SMR + CCS | Scalable, existing infrastructure | Carbon capture isn’t 100%, still tied to fossil gas |

| Fuel Cells | Clean electricity at point of use | Costly, limited lifespan, slow adoption |

Bottom line: The tech is here. Electrolysis is the future, SMR + CCS is the bridge, and fuel cells are the enabler. The next decade isn’t about invention-it’s about scaling and slashing costs.

Where Hydrogen Is Already in Action Today

Hydrogen is not just a buzzword-it’s already being tested in the real world. From cars on Tokyo streets to trains in Germany and steel mills in Sweden, hydrogen has left the lab and entered the marketplace. Let’s look at what’s happening today and what we can learn from it.

Hydrogen Cars in Japan

- Toyota Mirai and Honda Clarity are the poster children of hydrogen mobility.

- Japan has built over 160 hydrogen refueling stations, making it one of the world leaders.

- Lesson? Infrastructure is everything. Without fueling stations, even the best hydrogen cars won’t sell.

Hydrogen Trains in Germany

- Alstom’s Coradia iLint is the world’s first hydrogen-powered passenger train.

- It runs on routes where electrification is too expensive.

- Lesson? Hydrogen works best in niche areas where batteries or overhead wires don’t make sense.

Green Steel in Sweden

- Projects like HYBRIT (Hydrogen Breakthrough Ironmaking Technology) are replacing coal in steelmaking with hydrogen.

- This could cut 90% of CO₂ emissions from steel production.

- Lesson? Heavy industry might be hydrogen’s biggest playground, not cars.

Hydrogen in Action – Early Adoption Cases

| Application | Example | Key Lesson |

|---|---|---|

| Hydrogen Cars | Toyota Mirai, Honda Clarity | Needs infrastructure to scale |

| Hydrogen Trains | Alstom Coradia iLint (Germany) | Great for non-electrified routes |

| Green Steel | HYBRIT (Sweden) | Big emissions cuts in heavy industry |

Bottom line: Hydrogen isn’t science fiction-it’s happening right now. But adoption is highly sector-specific. Cars struggle without fueling networks, trains thrive in niche routes, and steel is shaping up to be hydrogen’s killer app.

Why Hydrogen Adoption Remains So Slow

If hydrogen is so promising, why isn’t it everywhere already? The truth is, while the tech is exciting, the road to mass adoption is full of potholes. Let’s break down the four biggest blockers.

High Production Costs

- Green hydrogen via electrolysis still costs $4–$6 per kilogram, compared to less than $1.50/kg for grey hydrogen.

- Electricity makes up 70–80% of production cost. If renewable power is expensive, green hydrogen can’t compete.

- Until we see cheap, abundant renewables + scaled-up electrolyzers, the economics won’t work.

Lack of Infrastructure

- Unlike EVs that can use the existing grid, hydrogen needs a whole new ecosystem: pipelines, refueling stations, storage tanks.

- Example: Japan has built ~160 hydrogen stations, but the US has fewer than 70 public ones (mostly in California).

- Without infrastructure, hydrogen adoption is like selling cars without roads.

Energy Efficiency Challenges

- Hydrogen is an energy carrier, not a primary source. That means conversion losses pile up.

- Electrolysis efficiency: ~65%

- Compression/liquefaction: -10–15%

- Fuel cell conversion back to electricity: ~60%

- Net result: You may lose up to 70% of the original energy by the time it powers a car or factory.

- Critics argue: “Why not just use electricity directly where possible?”

Policy & Regulatory Hurdles

- Hydrogen projects often face regulatory uncertainty-permits, safety codes, and subsidy rules vary country by country.

- Governments love announcing billion-dollar hydrogen roadmaps, but execution is painfully slow.

- Without stable long-term policy signals, investors hesitate.

Quick Reality Check

| Barrier | Why It Matters | Example |

|---|---|---|

| High Costs | Green H₂ = 3–4x more expensive than grey | $4–6/kg vs $1.50/kg |

| Infrastructure | Needs pipelines, refueling, storage | Only ~70 stations in the US |

| Efficiency Losses | Up to 70% energy wasted in the cycle | Critics: “Just electrify” |

| Policy Gaps | Inconsistent rules & subsidies | EU vs US subsidy race |

Bottom line: Hydrogen has the potential, but it’s running a marathon with weights on its ankles. Until costs fall, infrastructure expands, and efficiency improves, adoption will remain a slow burn.

Who’s Investing Billions in Hydrogen

If adoption is slow, why are governments and energy giants pouring billions of dollars into hydrogen? Simple: they see it as a long game. Whoever builds the hydrogen economy first could dominate global energy markets for decades. Let’s look at who’s putting serious skin in the game.

United States: IRA Subsidies & DOE Projects

- The Inflation Reduction Act (IRA) offers up to $3/kg tax credit for clean hydrogen. That’s game-changing-it could slash green hydrogen costs nearly in half.

- The Department of Energy (DOE) is funding $7 billion for regional “Hydrogen Hubs” across the US.

- Big focus: using hydrogen for heavy trucking, industrial decarbonization, and grid balancing.

Translation: The US wants to ensure it doesn’t just lead in EVs but also in the hydrogen economy.

European Union: The Hydrogen Roadmap

- The EU plans to produce 10 million tons of renewable hydrogen annually by 2030.

- Another 10 million tons is expected to be imported, making the EU a future hydrogen super-consumer.

- The European Hydrogen Bank is backing early projects with billions in subsidies.

- Countries like Germany, Spain, and the Netherlands are racing to be hydrogen leaders.

Europe sees hydrogen as the missing piece to meet its Fit for 55 and Net Zero 2050 targets.

Middle East: Saudi Arabia’s NEOM Mega Project

- Saudi Arabia is building the world’s largest green hydrogen plant in NEOM, worth $8.4 billion.

- Expected capacity: 600 tons of green hydrogen per day by 2026.

- Backed by Air Products, ACWA Power, and NEOM company, the project will produce ammonia for export.

The Middle East wants to stay the global energy hub-even when oil fades.

Big Energy Companies Betting on Hydrogen

- Shell: building Europe’s largest electrolyzer in Germany.

- BP: pushing hydrogen projects in the UK and Australia.

- TotalEnergies & Equinor: investing in blue hydrogen tied to CCS.

- Toyota & Hyundai: betting on hydrogen fuel-cell vehicles, even as EVs dominate headlines.

For these giants, hydrogen is not just greenwashing-it’s a hedge against losing relevance in the net-zero economy.

Quick Investment Snapshot

| Player | Investment Focus | Scale |

|---|---|---|

| US (IRA + DOE) | $3/kg tax credit + $7B hydrogen hubs | National rollout |

| EU | 10M tons domestic + 10M tons imports by 2030 | $100B+ pipeline |

| Saudi Arabia (NEOM) | $8.4B mega green H₂ plant | 600 tons/day |

| Big Energy & Automakers | Blue + green hydrogen projects | Multi-billion across regions |

Bottom line: Hydrogen adoption may be slow on the street, but in boardrooms and government halls, the money is already moving. The race isn’t about today-it’s about who owns the hydrogen future by 2030 and beyond.

The Road Ahead: Can Hydrogen Compete by 2030?

Hydrogen sounds exciting on paper-but here’s the billion-dollar question: can it actually compete with fossil fuels and electrification by 2030?

The next five years will decide whether hydrogen becomes a pillar of clean energy or just another overhyped buzzword.

Forecasts from IEA & BNEF

- IEA (International Energy Agency):

Predicts global hydrogen demand could reach 180 million tons by 2030 if governments stick to current pledges. That’s nearly double today’s usage. - BNEF (Bloomberg New Energy Finance):

Estimates green hydrogen costs could fall by 60% by 2030, hitting $1–2/kg in regions with cheap renewables. - Current reality: Green hydrogen is still $4–6/kg, making it uncompetitive with natural gas and even coal in many industries.

Translation: The math could work, but only if subsidies, technology scale-up, and infrastructure keep pace.

Cost Parity Scenarios

For hydrogen to compete, it needs to hit $2/kg or below. That’s the magic number:

- At $2/kg, hydrogen can compete with natural gas + carbon taxes in Europe.

- At $1.5/kg, it beats diesel in heavy trucking.

- Below $1/kg, it becomes viable for mass steelmaking without subsidies.

| Sector | Current Cost Barrier | Break-Even Hydrogen Price |

|---|---|---|

| Steel (blast furnace replacement) | Coal still cheaper | ~$1.5–2/kg |

| Shipping (ammonia fuel) | Heavy fuel oil dominant | ~$1.5–2/kg |

| Long-haul trucking | Diesel competitive | ~$1.5–2/kg |

| Power storage (seasonal) | Batteries + gas backup | ~$1–1.5/kg |

Bottom line: hitting $1–2/kg is the difference between hydrogen hype and hydrogen reality.

Hydrogen’s Role in the Net-Zero Race

Hydrogen won’t replace all fossil fuels, but it will likely dominate in hard-to-abate sectors:

- Steelmaking & cement → Green hydrogen is the only scalable alternative to coal and coke.

- Heavy transport & shipping → Batteries are too heavy for long-haul, hydrogen/ammonia is a fit.

- Grid balancing → Hydrogen can store excess renewable power for weeks or months, solving intermittency.

But here’s the catch: Without massive infrastructure build-out (pipelines, storage, refueling stations), adoption will lag-even if the economics look good.

Final thought for this section:

By 2030, hydrogen won’t be everywhere-but it will be everywhere that matters. The countries and companies that build early capacity now will control the supply chains, the costs, and ultimately, the future of clean industry.

FAQ + Conclusion + Call-to-Action

Frequently Asked Questions (FAQ)

Is hydrogen really safe?

Yes-but with caveats. Hydrogen is flammable, but so is natural gas and gasoline. The difference? Hydrogen disperses quickly when released, reducing the chance of fire compared to liquid fuels. Safety codes, leak detection, and proper infrastructure design make hydrogen handling manageable-similar to how we learned to safely use natural gas decades ago.

Why is hydrogen so expensive right now?

Because production relies on costly processes (like electrolysis) and infrastructure is still limited. Green hydrogen, in particular, needs renewable power + advanced electrolyzers, both of which are still scaling up. The good news: costs have already fallen by 50% in the past decade and are projected to keep dropping.

Which is better: blue or green hydrogen?

- Blue hydrogen: cheaper today but relies on natural gas and carbon capture (which isn’t 100% efficient).

- Green hydrogen: cleaner in the long term, since it’s made directly from renewable electricity and water.

Most experts see blue as a “stepping stone,” while green is the end goal.

Is hydrogen more efficient than batteries?

Not always. Batteries are more efficient for short-range cars or home energy storage. Hydrogen shines where batteries struggle: long-haul trucks, steelmaking, shipping, and aviation. Think of it as complementary, not competing.

Can hydrogen really hit mainstream adoption by 2030?

It depends on policy, investment, and tech breakthroughs. The IEA predicts hydrogen could reach cost parity with fossil fuels in some sectors by the late 2020s-especially with subsidies like the U.S. IRA and the EU’s Green Deal. But full global adoption? That’s more of a 2040-2050 story.

Conclusion: Why Hydrogen Matters More Than Ever

Hydrogen isn’t a silver bullet-but it is a critical puzzle piece in the clean energy transition. From powering green steel to decarbonizing shipping, it fills gaps where batteries and electrification simply can’t reach.

Right now, it faces growing pains: high costs, infrastructure gaps, and policy uncertainty. But history shows us that every major energy transition-coal, oil, natural gas-started the same way: expensive, messy, and doubted.

The difference this time? The climate clock is ticking. Hydrogen offers one of the few realistic pathways to decarbonize the hardest-to-abate sectors. Ignoring it isn’t an option.

Call-to-Action (CTA)

Want to go deeper?

👉 Check out our case studies on hydrogen in steel, shipping, and aviation.

👉 Subscribe to EngineerDaily.News for more real-world insights, breakdowns, and forecasts on clean energy.

👉 Stay ahead: because the hydrogen economy won’t wait until 2050 – it’s already being built today.