Why Digital Twin is a Game-Changer for Oil & Gas

Imagine this: you’re running a multi-billion-dollar offshore platform in the North Sea. Every day of downtime costs you around $1 million in lost production. A single equipment failure-like a pump breakdown or pipeline leak-can shut down operations for hours, sometimes days. And worse, if a safety incident occurs, you’re not just losing revenue-you’re risking lives, damaging your reputation, and facing regulatory fines that could run into the tens of millions.

This is the reality oil & gas executives live with every day. The pressure to maximize uptime, ensure worker safety, and meet strict environmental targets has never been higher. And here’s the kicker: traditional maintenance strategies, no matter how sophisticated, are no longer enough. Operators need more than inspections, monitoring, and scheduled shutdowns. They need foresight. They need a way to “see the future” of their assets.

Enter digital twin technology-arguably the biggest digital transformation wave to hit oil & gas since the introduction of SCADA systems decades ago.

So what makes it a game-changer? Unlike static dashboards or historical reports, a digital twin is a living, breathing replica of your physical asset-whether that’s a pipeline stretching 200 miles across Texas, a deepwater drilling rig, or a refinery unit processing 200,000 barrels per day. Connected with IoT sensors, powered by AI, and integrated into enterprise systems, digital twins give you real-time visibility and predictive intelligence that wasn’t possible just a few years ago.

And it’s not hype. According to MarketsandMarkets, the digital twin market in oil & gas is projected to grow from $2.1 billion in 2023 to $8.6 billion by 2028, with a CAGR of over 32%. Why such explosive growth? Because companies that have adopted digital twins are already reporting game-changing results:

- Shell reduced unplanned downtime by 20% in one refinery.

- BP uses digital twins on offshore platforms to cut inspection costs.

- Aramco is building one of the largest digital twin programs in the world to manage entire oil fields.

The message is clear: digital twin is no longer a buzzword-it’s becoming a must-have tool for asset integrity, safety, and efficiency in oil & gas.

What is a Digital Twin in Oil & Gas?

Let’s clear something up right away: a digital twin is not just a 3D model of your refinery or offshore platform. If that’s what you think, you’re underestimating one of the most powerful technologies reshaping the energy sector.

In oil & gas, a digital twin is best described as a dynamic, virtual replica of a physical asset or system, continuously updated with real-time data from IoT sensors, SCADA systems, and AI analytics. Think of it as having a “living mirror” of your pipeline, rig, or processing plant-one that not only shows you what’s happening right now but also predicts what will happen tomorrow.

Here’s a simple analogy: imagine driving your car with a GPS that doesn’t just show your current location but also forecasts traffic jams, suggests fuel stops, and even warns you about a failing brake pad before it happens. That’s exactly what a digital twin does-except on a billion-dollar scale in the oil & gas industry.

Core Elements of a Digital Twin in Oil & Gas

A proper digital twin integrates multiple layers of technology. Here’s a breakdown:

| Component | Role in Oil & Gas |

|---|---|

| IoT Sensors | Capture data from pumps, valves, compressors, pipelines. |

| SCADA Systems | Provide operational visibility and control. |

| AI & Machine Learning | Predict failures, optimize processes, detect anomalies. |

| 3D Visualization Models | Help engineers simulate and interact with assets in real time. |

| Cloud & Edge Computing | Enable scalability and real-time processing across remote sites. |

What makes digital twin different from traditional dashboards is the feedback loop. Data doesn’t just sit in a historian database—it’s fed back into the twin, allowing operators to simulate scenarios, test “what if” models, and optimize decisions before touching physical assets.

Why It Matters for Oil & Gas

The energy sector is asset-heavy and risk-intense. A single compressor outage in an LNG facility can cause $2–3 million in daily losses. A pipeline leak can result in environmental fines that run into the hundreds of millions. With a digital twin, companies don’t just react-they anticipate.

For example:

- A refinery can simulate the impact of adjusting feedstock blends before making real-world changes.

- Offshore rigs can run emergency drills virtually, testing dozens of scenarios without risking a single worker.

- Midstream operators can forecast corrosion in pipelines years ahead, enabling smarter maintenance schedules.

And here’s the kicker: according to Deloitte, companies that adopt digital twin technology in energy can see up to a 25% reduction in unplanned downtime and a 10–15% increase in operational efficiency.

In short, a digital twin isn’t just “nice to have”-it’s quickly becoming the digital backbone of oil & gas operations. If your competitors are building them while you’re still stuck with siloed data and paper checklists, you’re not just behind-you’re invisible in the race toward the future.

Key Use Cases Driving Adoption

Here’s the truth: the oil & gas industry doesn’t invest in buzzwords-it invests in results. Digital twin technology isn’t taking off because it sounds futuristic; it’s taking off because it solves painful, expensive problems that operators have struggled with for decades.

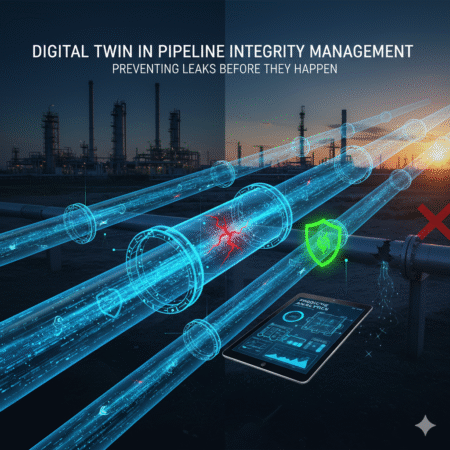

Imagine this:

A subsea pipeline starts showing early signs of corrosion. In the past, you’d either rely on scheduled inspections (costly and slow) or wait until a leak happened (disastrous). With a digital twin, IoT sensors pick up micro-changes in pressure and temperature. That data flows into the twin, which runs simulations and predicts that a leak will likely occur in nine months. Engineers can now plan targeted maintenance at a fraction of the cost, avoiding both downtime and environmental disaster. That’s not science fiction-it’s what companies like BP and Shell are already doing.

So where exactly are digital twins making the biggest impact? Let’s break it down.

Read More: Digital Twin and AI Synergy in Plant Operations

Asset Integrity Management

Asset integrity is the backbone of oil & gas safety. Digital twins can predict:

- Corrosion in pipelines and offshore platforms.

- Valve degradation in refineries.

- Structural fatigue in rigs.

McKinsey estimates that digital twin–enabled integrity monitoring can cut inspection costs by up to 30% while reducing the risk of catastrophic failures.

Predictive Maintenance

Unplanned downtime is the enemy of profitability. A single day of production loss on an offshore platform can cost $2–3 million. Digital twins use AI + sensor data to:

- Detect anomalies in compressors, pumps, and turbines.

- Forecast equipment failure weeks in advance.

- Optimize spare parts inventory.

Result? Up to 25% reduction in downtime, according to Deloitte.

Process Optimization

Every barrel of oil or cubic meter of gas counts. Digital twins simulate entire refinery or processing operations to:

- Optimize feedstock blending.

- Maximize energy efficiency.

- Improve yield on high-value products.

For example, Shell used a refinery digital twin to improve efficiency and saved millions annually in energy costs.

Safety & Risk Management

Oil & gas is high-risk by nature. Digital twins let operators test “what-if” scenarios before disaster strikes:

- Simulating blowout preventer failures.

- Modeling gas leaks or explosions in refineries.

- Training staff in virtual emergency drills.

This reduces both safety incidents and insurance premiums-a win for operators and regulators alike.

Quick Recap (At a Glance)

| Use Case | Problem Solved | Impact |

|---|---|---|

| Asset Integrity Management | Corrosion, fatigue, leaks | 30% cost reduction |

| Predictive Maintenance | Unplanned downtime, high repair costs | 25% downtime reduction |

| Process Optimization | Low yield, energy waste | Millions saved annually |

| Safety & Risk Management | High accident risk, training gaps | Fewer incidents & lower insurance costs |

Bottom line: Digital twins aren’t just another IT project-they’re becoming the new control tower of oil & gas operations, driving safety, efficiency, and profitability in ways that were unthinkable just a decade ago.

Benefits for Operators & Investors

Here’s the harsh reality: oil & gas companies are under constant pressure-cut costs, improve safety, and prove ESG commitments-all while still meeting global demand. Digital twin technology checks all three boxes. And that’s why investors love it just as much as operators do.

Let’s start with a story.

In 2023, a large offshore operator in the Gulf of Mexico faced recurring compressor failures that caused over $25 million in unplanned downtime annually. After deploying a digital twin to simulate operations and monitor sensor data in real time, they reduced failures by 40% and cut downtime by half. The ROI? Achieved within the first 18 months.

This isn’t an isolated case. According to PwC, companies adopting digital twin technology in energy-intensive industries have reported OPEX reductions of up to 15% and CAPEX savings of up to 10% by avoiding unnecessary replacements and extending asset lifespans.

So, what exactly makes digital twins such a financial and operational win? Let’s break it down.

Lower OPEX and CAPEX

- Operational Expenditure (OPEX): Less downtime, optimized maintenance, and fewer site visits.

- Capital Expenditure (CAPEX): Better asset lifecycle management means fewer premature equipment replacements.

Example: A digital twin-driven pipeline monitoring system can delay a $200M replacement project by extending lifespan through predictive maintenance.

Reduced Downtime = Millions Saved

- Every day of downtime offshore can cost $2–3 million.

- Digital twins reduce unplanned downtime by up to 25–30% (Deloitte).

- For a mid-size operator, that could mean $50M+ in annual savings.

Improved ESG Reporting & Sustainability Scores

Investors are watching ESG (Environmental, Social, Governance) performance closely. Digital twins provide:

- Transparent carbon emission tracking.

- Energy efficiency metrics.

- Data for regulatory compliance and sustainability audits.

A refinery using a digital twin to optimize heat exchangers reported a 10% reduction in CO₂ emissions, directly improving their ESG scorecard.

Faster, Data-Driven Decisions

In oil & gas, delays cost money. Digital twins give decision-makers real-time visibility across upstream, midstream, and downstream assets.

- Executives can model “what-if” scenarios before approving multi-million-dollar projects.

- Engineers can simulate safety risks before sending crews offshore.

This speed and clarity not only improve operations but also increase investor confidence because the company shows it’s future-proofing its assets.

Quick Recap (At a Glance)

| Benefit | Impact for Operators | Impact for Investors |

|---|---|---|

| Lower OPEX & CAPEX | Reduced maintenance & replacement costs | Higher profitability & asset longevity |

| Reduced Downtime | Millions saved annually | Stable production = stable returns |

| ESG & Sustainability Reporting | Better compliance, reduced emissions | Stronger ESG ratings attract capital |

| Faster Decision-Making | Real-time risk analysis & project simulations | Confidence in management’s foresight |

Bottom line: For operators, digital twins mean safer, leaner, and more efficient operations. For investors, they’re a signal that a company isn’t just surviving in a volatile market-it’s positioning itself as a leader in the energy transition.

Challenges Holding Back Adoption

Here’s the uncomfortable truth: while digital twins sound like the perfect solution, adoption in oil & gas hasn’t been smooth sailing. For every success story, there are operators quietly shelving pilot projects because the tech proved harder, pricier, or riskier than expected.

Take this example: a North Sea operator launched a $50M digital twin initiative to monitor an aging offshore platform. The idea was to extend asset life and avoid costly shutdowns. But within two years, the project stalled-why? The integration of legacy SCADA data with cloud-based AI systems turned into a nightmare, cybersecurity concerns skyrocketed, and costs ballooned beyond the initial budget.

This isn’t rare. In fact, Deloitte’s 2024 survey on digital oilfield adoption noted that 40% of operators cited “data integration complexity” as the biggest barrier, while one in three flagged high upfront cost as a deal-breaker.

Let’s break down the main challenges.

High Upfront Cost of Deployment

- Full-scale digital twins for offshore platforms or refineries can cost tens to hundreds of millions of dollars.

- ROI is often delayed-sometimes 3–5 years, depending on asset complexity.

- Smaller operators or NOCs with tight budgets hesitate to commit.

For investors, this creates uncertainty: “Will the savings materialize fast enough?”

Data Integration Complexity

- Legacy SCADA, DCS, and PI historian systems weren’t designed for cloud-native AI analytics.

- Operators often juggle 20+ different vendors and platforms-making seamless integration extremely challenging.

- Data silos mean the digital twin may only offer partial visibility instead of a true “single source of truth.”

Cybersecurity & Data Ownership Risks

- Digital twins are heavily dependent on real-time data streaming from critical infrastructure.

- This makes them prime targets for cyberattacks.

- Who owns the data-the operator, the service provider, or the cloud platform?

- A 2023 IBM report found that the average cost of a cyberattack in the energy sector is $4.72M per incident-a risk that boards cannot ignore.

Talent & Culture Gap

- Traditional oil & gas engineers may lack the digital skills to design, run, and maintain twins.

- Companies face a shortage of hybrid talent: people who understand both process engineering and AI/IoT.

- Resistance to change is real: field crews may distrust “virtual models” that tell them how to run assets.

Quick Recap (At a Glance)

| Challenge | Impact on Operators | Impact on Investors |

|---|---|---|

| High Upfront Cost | Budget overruns, delayed ROI | Uncertainty in payback period |

| Data Integration Complexity | Fragmented visibility, stalled projects | Higher risk of project failure |

| Cybersecurity Risks | Vulnerability to attacks, data disputes | Potential liabilities & compliance risks |

| Talent Gap & Culture | Slow adoption, skill shortages | Question mark on scalability |

Bottom line: Digital twins in oil & gas are not plug-and-play solutions. The tech is powerful, but without proper planning, the risks can outweigh the rewards. Operators need clear ROI roadmaps, secure data strategies, and strong talent pipelines to avoid becoming one of those failed case studies whispered about at industry conferences.

Case Studies: Who’s Leading the Way

When you hear the term “digital twin,” it’s easy to think it’s just another buzzword that consultants throw around in boardrooms. But here’s the truth: some of the world’s largest oil & gas players are already putting digital twins to work-and they’re seeing results that would make any CFO smile.

Let’s break it down with three big names you definitely know: Shell, BP, and Saudi Aramco.

Shell: Refinery Optimization at Scale

Shell has been experimenting with digital twins across its refineries for years, but in 2023 they rolled out one of their biggest projects in Singapore. By creating a virtual replica of an entire refining complex, Shell gave engineers the ability to simulate everything-from crude oil blending to heat exchanger efficiency-without ever touching the physical plant.

The payoff? According to Shell’s digitalization report, refinery efficiency improved by nearly 8% in energy use, while maintenance costs dropped significantly. In practical terms, that’s tens of millions of dollars saved annually, all while reducing CO₂ emissions in line with Shell’s net-zero commitments.

BP: Predictive Maintenance on Offshore Platforms

Offshore rigs are notorious for downtime costs-some estimates put it at $300,000 to $500,000 per day when operations stall. BP tackled this by building digital twins of its North Sea platforms.

Using IoT sensors feeding real-time data into the twin, BP engineers can now predict when pumps, compressors, or drilling equipment are likely to fail. Instead of waiting for breakdowns, they schedule maintenance ahead of time.

The result? BP reported a 20% reduction in unplanned downtime across selected assets. That’s not just operational efficiency-it’s the difference between hitting production targets and losing millions in revenue.

Saudi Aramco: A Mega Digital Twin for Oil Fields

If Shell and BP are innovating, Saudi Aramco is going for scale. The Saudi giant has invested billions into creating a field-wide digital twin-a massive virtual replica that covers everything from upstream reservoirs to midstream pipelines.

Why? Because when you operate some of the largest oil fields on the planet, even a 1% efficiency improvement can mean billions in savings. Aramco’s digital twin integrates seismic data, drilling performance, and production metrics, enabling engineers to run simulations on enhanced oil recovery, optimize well placements, and even monitor methane leaks for ESG compliance.

This project is so massive that analysts predict it will become the blueprint for future “nation-scale” digital twin rollouts in energy.

The Takeaway

These aren’t hypothetical use cases. They’re real-world deployments showing that digital twins are no longer an experiment-they’re a competitive edge. The common thread across Shell, BP, and Aramco? Each of them is leveraging digital twins not just to save money, but to future-proof their operations in an industry where safety, sustainability, and profitability are under the microscope.

If the industry giants are betting big on digital twins, the question isn’t “should you invest?”-it’s “how soon can you afford not to?”

Future Outlook: Digital Twin in Oil & Gas 2030

Here’s the thing: if you think digital twin adoption today is impressive, wait until you see what’s coming by 2030. Right now, oil & gas companies are still scratching the surface-testing twins in pilot projects, optimizing select assets, and showcasing them at investor presentations. But over the next five years, digital twins are set to move from “innovation projects” to “industry standard.”

Market Forecast: From Millions to Billions

According to MarketsandMarkets, the global digital twin market for oil & gas is projected to skyrocket from $3 billion in 2025 to over $13 billion by 2030. That’s a CAGR of 30%+, which puts it among the fastest-growing digital technologies in the energy sector.

Why such explosive growth? Because operators are realizing that digital twins aren’t just about efficiency-they’re about survival in an industry facing decarbonization mandates, volatile energy prices, and increasing pressure from ESG investors.

Imagine this: a refinery that saves just 2% in energy costs annually with a twin could translate to hundreds of millions of dollars in savings. Multiply that across global assets, and suddenly the ROI isn’t just attractive-it’s irresistible.

The Role in Decarbonization & Hydrogen Economy

Net-zero commitments are no longer optional. By 2030, many oil majors-Shell, BP, TotalEnergies-have pledged massive reductions in their carbon footprint. Digital twins will be the “silent engine” powering these goals.

For example:

- Carbon capture plants will use digital twins to simulate and optimize CO₂ separation efficiency.

- Hydrogen infrastructure-pipelines, storage, refueling stations-will rely on twins to detect leaks, optimize flow, and ensure safety in handling hydrogen (a notoriously tricky molecule).

- Methane emissions monitoring will be handled in real-time with AI-powered twins, giving operators verifiable data to share with regulators and investors.

Simply put, without digital twins, achieving net-zero will be close to impossible.

AI + Digital Twin = Autonomous Operations

Here’s where it gets really exciting. By 2030, we won’t just be talking about digital twins as “decision support tools.” We’ll be talking about autonomous operations.

Imagine an offshore rig in the Gulf of Mexico:

- Sensors feed real-time data into the twin.

- AI models run predictive simulations.

- The system autonomously adjusts pumps, valves, and compressors.

- Engineers onshore monitor from a control center, intervening only when needed.

This isn’t sci-fi-it’s already happening in early forms at Aramco and Equinor. By 2030, fully autonomous oilfields powered by digital twins and AI could reduce manpower requirements by 30-40%, slash downtime, and boost safety in hazardous environments.

The Big Picture

The future of digital twins in oil & gas is not about whether companies will adopt them-it’s about how fast they can scale. Those who wait risk falling behind competitors who are already locking in efficiency gains, ESG credibility, and investor confidence.

By 2030, the industry’s winners will be the ones who treat digital twins not as an optional tool, but as the backbone of their digital transformation.

So the question for operators, investors, and decision-makers is simple: Are you building your digital twin strategy now-or will you be playing catch-up in five years?

FAQ + Conclusion + CTA

FAQ: The Questions Everyone is Asking

1. How much does a digital twin cost in oil & gas?

The cost varies widely-anywhere from $1 million for a single-asset pilot project to $50–100 million for enterprise-wide deployment. But here’s the kicker: most operators report ROI within 18–24 months, thanks to reduced downtime and improved efficiency.

2. What’s the ROI like?

Think of it this way: an unplanned outage on an offshore platform can cost $3–5 million per day. If a digital twin prevents just one such incident per year, the investment already pays for itself.

3. Is it safe to integrate with SCADA and existing control systems?

Yes, but cybersecurity is a top priority. Companies like BP and Aramco are implementing zero-trust architectures and segmented networks to protect digital twin environments. Vendors are also offering cloud + on-prem hybrid models to balance flexibility and security.

4. Do we have the talent to run digital twins?

This is the elephant in the room. Oil & gas companies are partnering with universities, tech firms, and even gaming companies (yes, gaming!) to source talent skilled in 3D modeling, AI, and simulation engineering. The talent shortage is real-but it’s also creating opportunities for new careers in energy digitalization.

Conclusion: Digital Twin Is No Longer Optional

Here’s the truth: the oil & gas sector has always been about managing risk and maximizing returns. But in 2025 and beyond, those who rely on traditional methods will fall behind. Digital twins aren’t just a shiny tech trend-they’re the backbone of the industry’s future.

Think about it:

- Shell is saving millions per year in refinery optimization.

- BP has slashed downtime with predictive maintenance.

- Aramco is building twins of entire oilfields, essentially creating “mirror worlds” of its assets.

The message is clear: digital twins have moved from “nice-to-have” to must-have. By 2030, they will be as essential as SCADA or DCS in every major operation.

Call-to-Action (CTA): Don’t Just Watch-Act

If you’re an operator, investor, or decision-maker in the oil & gas industry, the question isn’t “Should we adopt digital twins?” It’s “How fast can we scale?”

👉 Stay ahead of the curve. Subscribe to EngineerDaily.News for weekly insights on digitalization, AI, and the future of energy. Get the strategies, case studies, and market data you need to make confident decisions.

Because in the race toward efficiency, safety, and sustainability-the winners will be those who build their digital twin strategy today, not tomorrow.